Exactly How Livestock Risk Security (LRP) Insurance Can Protect Your Livestock Investment

In the realm of livestock financial investments, mitigating threats is paramount to guaranteeing economic stability and growth. Animals Risk Security (LRP) insurance stands as a reliable shield versus the unpredictable nature of the marketplace, offering a calculated strategy to protecting your properties. By delving into the ins and outs of LRP insurance policy and its multifaceted benefits, animals manufacturers can fortify their financial investments with a layer of security that transcends market changes. As we check out the world of LRP insurance coverage, its function in safeguarding animals investments becomes progressively apparent, guaranteeing a path in the direction of lasting economic strength in an unpredictable sector.

Understanding Livestock Danger Protection (LRP) Insurance

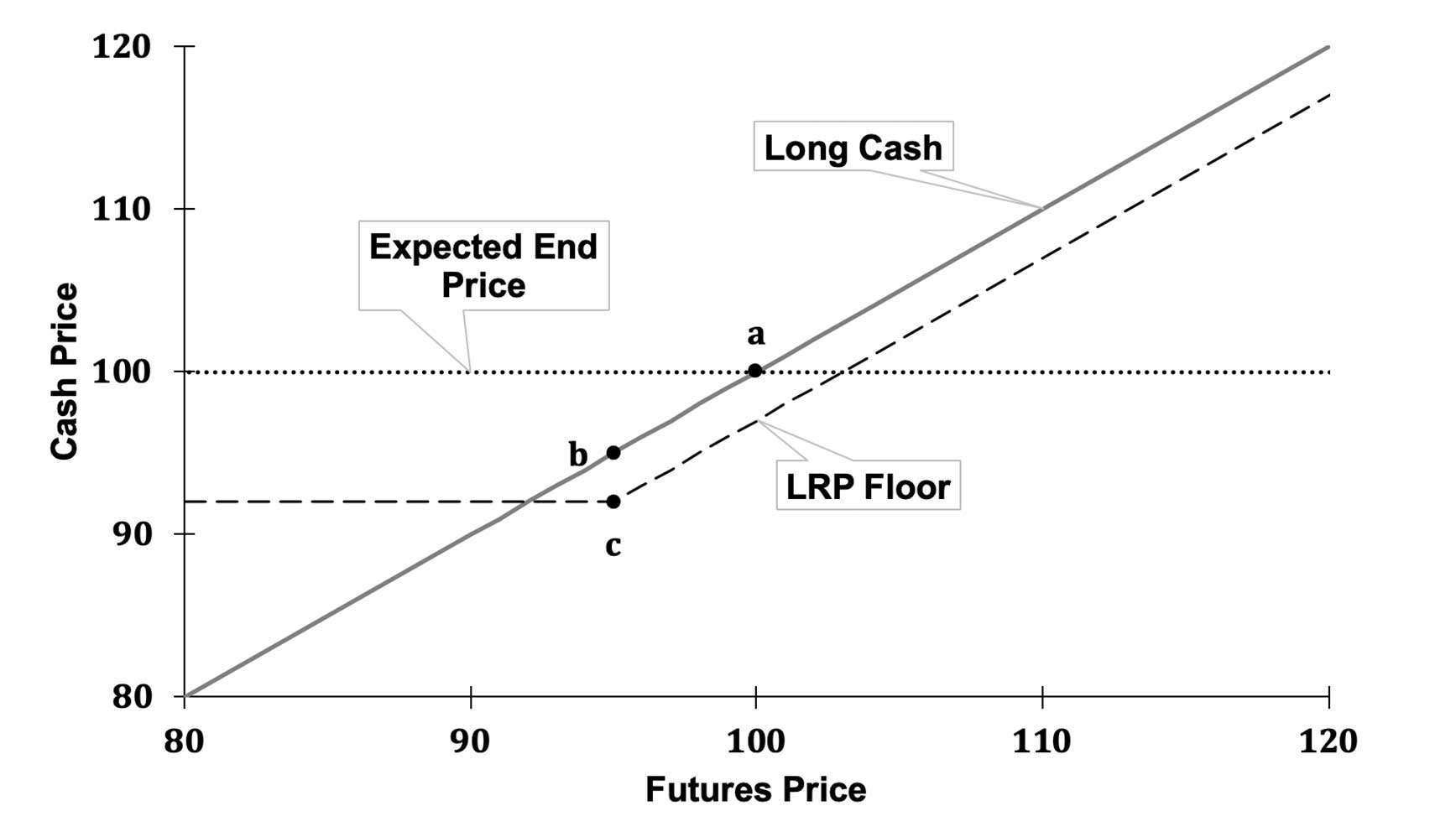

Recognizing Livestock Threat Security (LRP) Insurance coverage is important for animals manufacturers wanting to mitigate economic threats connected with price variations. LRP is a federally subsidized insurance policy item created to protect manufacturers against a decline in market value. By providing coverage for market value declines, LRP assists producers lock in a flooring cost for their animals, ensuring a minimal level of profits no matter of market changes.

One key element of LRP is its flexibility, enabling producers to customize insurance coverage levels and plan sizes to suit their certain requirements. Manufacturers can select the variety of head, weight range, protection rate, and coverage duration that align with their production objectives and risk tolerance. Comprehending these customizable choices is crucial for producers to properly handle their price danger exposure.

Furthermore, LRP is readily available for numerous livestock types, including cattle, swine, and lamb, making it a versatile danger administration device for animals manufacturers across various fields. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make educated choices to guard their investments and ensure financial stability when faced with market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Animals Threat Defense (LRP) Insurance coverage gain a tactical advantage in shielding their investments from cost volatility and safeguarding a steady economic ground amidst market uncertainties. By establishing a floor on the cost of their animals, manufacturers can minimize the threat of considerable economic losses in the occasion of market downturns.

Additionally, LRP Insurance coverage supplies producers with assurance. Recognizing that their financial investments are guarded against unforeseen market changes allows manufacturers to concentrate on other facets of their service, such as improving pet health and wellness and welfare or optimizing production procedures. This satisfaction can result in boosted productivity and profitability over time, as manufacturers can run with more confidence and stability. Overall, the benefits of LRP Insurance for animals producers are considerable, using an important tool for handling threat and guaranteeing financial safety and security in an unpredictable market environment.

Exactly How LRP Insurance Mitigates Market Dangers

Reducing market risks, Animals Threat Defense (LRP) Insurance policy offers animals producers with a reliable shield against cost volatility and financial unpredictabilities. By using defense against unexpected price drops, LRP Insurance policy helps manufacturers safeguard their financial investments and keep financial security despite market changes. This sort of insurance coverage permits livestock manufacturers to secure in a price for their animals at the beginning of the policy duration, making sure a minimum rate level no matter market changes.

Steps to Safeguard Your Animals Investment With LRP

In the world of farming threat administration, implementing Livestock Risk Protection (LRP) Insurance includes a critical process to secure investments against Click Here market fluctuations and unpredictabilities. To safeguard your livestock financial investment successfully with LRP, the very first step is to assess the certain risks your procedure encounters, such as price volatility or unforeseen weather condition events. Next, it is important to research and pick a credible insurance policy service provider that uses LRP policies tailored to your livestock and organization requirements.

Long-Term Financial Safety With LRP Insurance

Guaranteeing withstanding economic security via the usage of Animals Risk Security (LRP) Insurance is a sensible long-lasting technique for agricultural producers. By integrating LRP Insurance policy right into their threat monitoring strategies, farmers can guard their livestock financial investments against unpredicted market changes and unfavorable events that can jeopardize their monetary well-being with time.

One secret advantage of LRP Insurance coverage for lasting financial protection is the assurance it offers. With a dependable insurance coverage policy in place, farmers can alleviate the financial threats related to unstable market conditions and unexpected losses browse around this site as a result of aspects such as disease break outs or natural catastrophes - Bagley Risk Management. This stability enables producers to concentrate on the everyday procedures of their animals service without continuous bother with possible economic obstacles

Additionally, LRP Insurance coverage gives an organized approach to handling threat over the long-term. By establishing specific coverage levels and selecting appropriate endorsement durations, farmers can customize their insurance plans to align with their monetary objectives and risk tolerance, ensuring a safe and secure and lasting future for their livestock operations. To conclude, purchasing LRP Insurance policy is a proactive approach for farming manufacturers to achieve lasting economic safety and protect their resources.

Verdict

In final thought, Livestock Threat Security (LRP) Insurance is a useful tool for livestock producers to alleviate market risks and protect their financial investments. It is a smart option for guarding animals financial investments.